Introduction

The value of the US dollar (USD) plays a crucial role in global finance, trade, and investments. However, with the rise of cryptocurrencies, a new form of “digital dollar” has emerged—stablecoins like USDT (Tether) and USDC (USD Coin), which are pegged to the USD.

In this article, we’ll explore:

- The factors affecting the US dollar’s price

- How crypto dollar prices (stablecoins) work

- Key differences between traditional USD and crypto dollars

- The impact of inflation, interest rates, and regulations

- Future trends in dollar valuation and crypto markets

By the end, you’ll have a clear understanding of how both systems operate and their influence on the economy.

1. What Determines the US Dollar (USD) Price?

The US dollar is the world’s primary reserve currency, and its value fluctuates based on several economic factors:

A. Inflation & Purchasing Power

- When inflation rises, the dollar’s purchasing power decreases.

- The Federal Reserve (Fed) adjusts interest rates to control inflation.

B. Interest Rates & Monetary Policy

- Higher interest rates attract foreign investors, increasing demand for USD.

- Quantitative easing (money printing) can weaken the dollar’s value.

C. Economic Growth & GDP

- A strong US economy boosts confidence in the dollar.

- Recessions or debt crises can lead to depreciation.

D. Geopolitical Stability

- The USD is considered a “safe haven” during global crises.

- Wars, sanctions, and political instability affect currency strength.

E. Trade Balance & Foreign Exchange Reserves

- The US trade deficit (importing more than exporting) can weaken the dollar.

- Countries holding USD reserves influence exchange rates.

2. What Is the “Crypto Dollar”? (Stablecoins Explained)

Cryptocurrencies like Bitcoin are volatile, making them unsuitable for daily transactions. To solve this, stablecoins were introduced—digital tokens pegged 1:1 to the US dollar.

Types of Crypto Dollars (Stablecoins)

- Fiat-Backed Stablecoins (USDT, USDC, BUSD)

- Backed by real USD reserves in banks.

- Example: Tether (USDT) claims each token is backed by $1 in reserves.

- Algorithmic Stablecoins (DAI, FRAX)

- Use smart contracts to maintain peg without full fiat backing.

- Example: DAI is backed by crypto collateral.

- Commodity-Backed Stablecoins

- Pegged to assets like gold or oil (less common).

How Crypto Dollars Maintain Their Peg

- Regular audits (for fiat-backed coins).

- Smart contract adjustments (for algorithmic coins).

- Market demand and arbitrage trading.

3. Key Differences: Traditional USD vs. Crypto Dollar

| Factor | Traditional USD | Crypto Dollar (Stablecoins) |

|---|---|---|

| Issuer | Federal Reserve | Private companies (Tether, Circle) |

| Backing | Full faith of US govt. | Fiat reserves or algorithms |

| Transaction Speed | Slow (banks, SWIFT) | Instant (blockchain) |

| Fees | High (wire transfers) | Low (crypto networks) |

| Regulation | Strict (centralized) | Less regulated (decentralized) |

| Privacy | Low (bank tracking) | Medium (pseudo-anonymous) |

4. How Inflation & Interest Rates Affect Both

A. Impact on Traditional USD

- High inflation → Dollar loses value → Fed raises interest rates.

- Strong dollar makes exports expensive, hurting trade.

B. Impact on Crypto Dollars

- If USD inflates, stablecoins should remain pegged (1 USDT = $1).

- If a stablecoin loses peg (like UST in 2022), panic selling occurs.

5. Risks & Challenges

A. Risks with Traditional USD

- Hyperinflation (rare but possible).

- Government default (if debt becomes unsustainable).

B. Risks with Crypto Dollars

- Lack of transparency (Tether’s reserves controversy).

- Regulatory crackdowns (SEC lawsuits against stablecoins).

- Depegging risk (UST collapse in 2022).

6. Future Trends: Will Crypto Replace the Dollar?

- CBDCs (Central Bank Digital Currencies): Governments are exploring digital versions of fiat.

- Stablecoin adoption: More businesses accept USDT/USDC for payments.

- Regulation: The US and EU are tightening stablecoin rules.

Conclusion

The US dollar remains the dominant global currency, but crypto dollars (stablecoins) offer faster, cheaper transactions. However, risks like depegging and regulation remain.

For long-term stability, traditional USD is safer, but for fast cross-border payments, crypto dollars are gaining traction. Investors should diversify and stay updated on Fed policies and crypto regulations.

FAQs

Q1. Is USDT safer than USD?

No, USDT carries counterparty risk (Tether’s reserves may not be fully backed).

Q2. Can stablecoins replace banks?

Partially—they offer faster payments but lack lending/credit services.

Q3. Why does the Fed hate crypto dollars?

They threaten central bank control over money supply.

Q4. What happens if the dollar collapses?

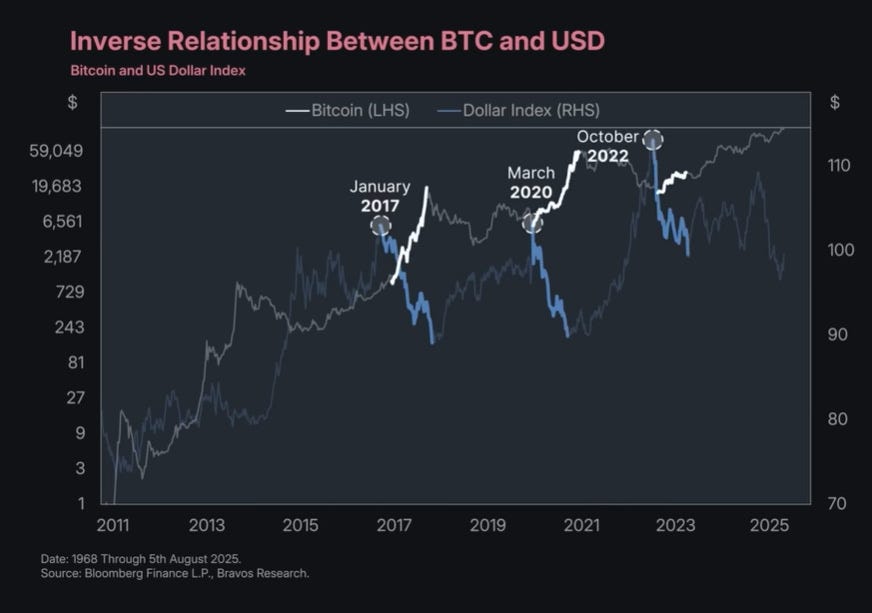

Stablecoins may lose peg, Bitcoin could rise as a hedge.

This article covers everything from dollar valuation to crypto alternatives. If you found it helpful, share it with others interested in finance and crypto! 🚀

#DollarPrice #CryptoDollar #Stablecoins #USDvsCrypto #Bitcoin #Finance